In the Field

Francis Palasieski, ABMA’s Director of Government Affairs.

Tariffs Are Filling the Treasury, Not Driving Up Prices

On October 14, the Administration’s new 10% tariff on softwood lumber takes effect. For Canadian lumber, that’s on top of existing antidumping and countervailing duties, pushing total trade costs to more than 45%.

But here’s the headline for our industry: tariffs are driving federal revenue, not lumber prices.

ABMA’s April Win

Back in April, when the Administration first rolled out a sweeping round of tariffs, ABMA secured a complete exemption for lumber products.

At the time, there was heavy volatility across the market. Retailers and suppliers were bracing for steep price increases that never came. In fact, in the months after those tariffs were enacted, our channel moved quickly from uncertainty back to relative stability. Price pressures eased, and large increases never made their way down the chain.

That experience shifted the conversation. Instead of “Price increases are coming.” the question became: “If not now — then when?”

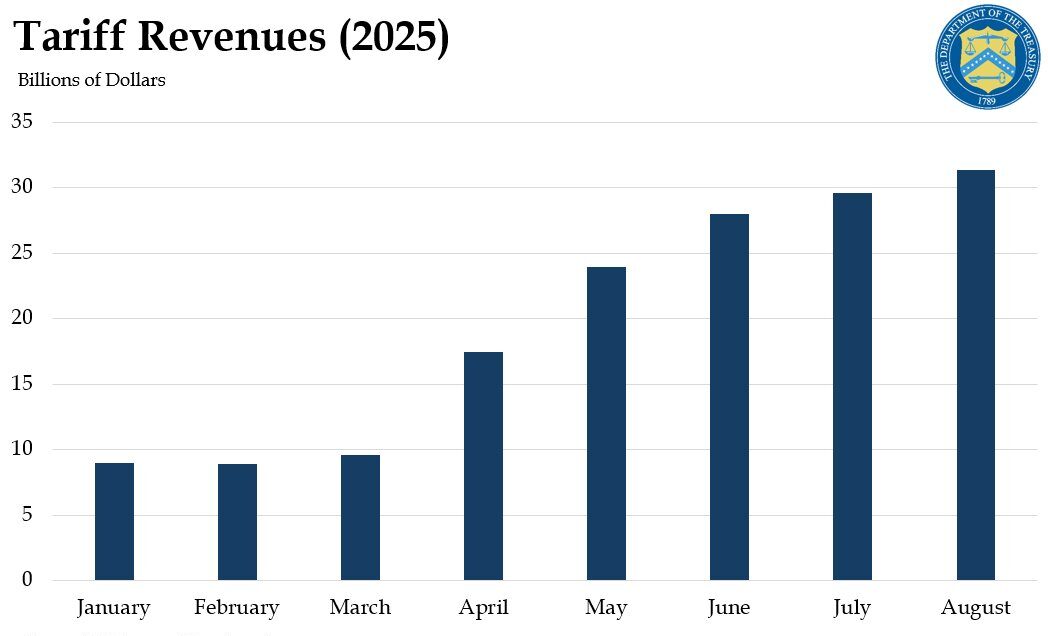

Revenues Surge

According to Treasury, customs duty collections have reached more than $30B per month. If sustained the Congressional Budget Office estimates that’s enough to cover roughly 15–20% of the federal deficit.

The Secretary of Treasury has said these receipts will be directed toward deficit reduction. Compared to workforce cuts or claw backs of federal grants, which are politically visible but modest, tariffs are emerging as Washington’s most powerful fiscal lever.

Source: U.S. Department of Treasury

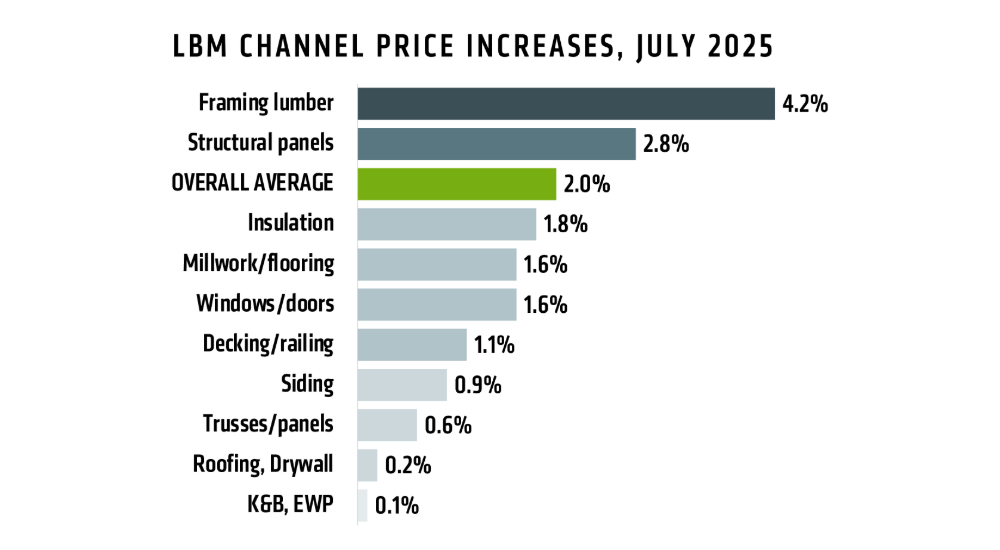

Prices Holding Steady

Meanwhile, across the LBM channel, prices remain steady.

Softwood lumber: indices have shown little discernible movement in relation to the hikes on Canadian duties, and the coming October 14th tariffs on softwood lumber.

Other building products: the average increase across goods in our sector through July is just 2%.

We believe Canadian exporters and U.S. buyers may have front-loaded imports ahead of the duties hike, cushioning short-term price impacts. We’ll know more once Customs and Border Protection releases July–August import data.

Looking Ahead: Housing Policy

Rather than focusing further on tariff policy, ABMA will now direct its full attention toward housing policy.

We also want to extend our thanks to Greg Brooks and the LBM Executive Council for hosting ABMA at their recent event in Lake George. The conversations we had there were not only valuable, but the insights shared have directly informed our positions on both housing policy and tariffs. Their perspective from the front lines of the LBM industry continues to shape how we engage with policymakers in Washington.

Our lobbyist, Jim Thompson, reports that in his conversations with White House aides, the administration is preparing to make a bold play on housing and, thanks to Jim, ABMA is well positioned to contribute meaningful proposals.

We will seek to weigh in on permitting reform and on mandates that go beyond the standard building code. From sprinkler mandates to all-electric requirements, we believe that government-driven costs are pushing hundreds of thousands—if not millions—of prospective buyers out of the market by pricing them out of homeownership.

As Washington turns toward housing affordability, ABMA will ensure our industry’s perspective is part of the solution.