Escalating Tariffs and the Ongoing Impact on the Lumber Industry

The one-month delay is ending, and President Trump has confirmed that the global 25% tariff on lumber will take effect on March 4. However, this is not the only tariff increase on the horizon.

Thanks to insights from ABMA committee member Karen Handel, President of the Construction Suppliers Association (CSA), we are aware that the U.S. Department of Commerce is expected to announce additional anti-dumping duties on Canadian softwood lumber later today. These duties could be as high as 14% on top of the current 14.4% tariff, bringing the total burden on Canadian imports to nearly 30% before the global tariff is even applied.

Adding to the pressure, the administration has also announced an additional 10% tariff on Chinese goods, doubling the 10% increase that was already put in place in February. This will further impact supply chains for building materials and other critical goods.

Why Canadian Lumber Remains the Focus

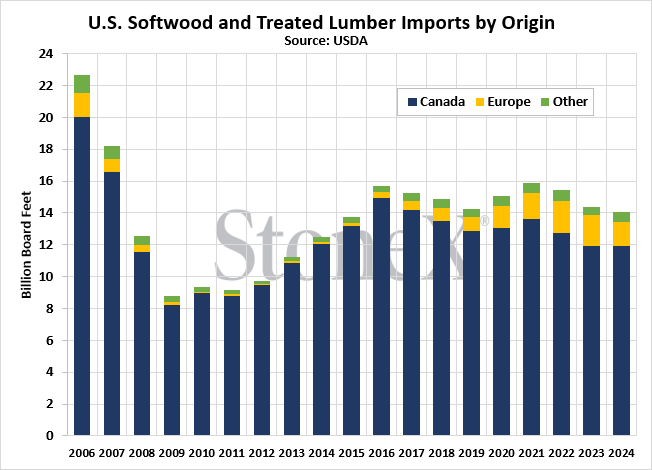

Although the administration’s new global tariff applies to all imported lumber, the overwhelming majority of U.S. lumber imports—12 billion out of 14 billion board feet last year—came from Canada. This makes Canadian softwood lumber the most critical source of supply affected by these policies.

The Tariff Fallout: Pricing Volatility and Labeling Challenges

Beyond rising costs, ABMA members are also dealing with the constant need to update product labels as a result of the volatile market created by these tariffs.

While labeling regulations themselves haven’t changed, the dramatic shifts in pricing caused by ongoing trade disputes have forced businesses to continuously update thousands of product labels to ensure compliance with tariff-driven cost adjustments. The unpredictability of these price swings is making it increasingly difficult for members to manage inventory, plan purchases, and maintain stability in their businesses.

The Current Tariff Landscape and Its Potential Impact

Before these latest actions, Canadian softwood lumber was already facing a 14.4% duty due to ongoing U.S. trade disputes. These duties stem from the long-standing claim that Canadian lumber producers benefit from unfair subsidies, making their exports artificially competitive against U.S. timber.

Now, with the anticipated 14% anti-dumping duty increase and the 25% global tariff on all lumber imports, Canadian softwood could be subject to nearly 40% in total duties—an increase that could affect the cost and availability of lumber in the U.S.

Trade experts also caution that the Commerce Department regularly reviews these tariffs and could adjust them even higher depending on the findings of ongoing investigations. If U.S. policymakers continue pushing protectionist measures, tariffs on Canadian lumber could climb even further in the months ahead.

ABMA Pushes Back in Washington

ABMA’s lobbyist, Jim Thompson, is on Capitol Hill meeting with legislators and administration officials, directly highlighting the burden these tariffs place on lumber dealers, contractors, and homeowners.

One key message: Tariffs will not make American lumber more competitive—they will only drive up costs for everyone. Canadian softwood lumber is already subject to tariffs, and with the potential for an additional anti-dumping duty increase on top of the 25% global tariff, we are facing the risk of a runaway escalation in costs. ABMA is proactively working to head off this uncontrolled surge by urging an exemption for Canadian SPF lumber, given its crucial role in construction markets. Without action, businesses and families across the nation will bear the brunt of excessive and unpredictable price hikes.