Event Schedule

Legislative Issues Briefing | 2:30 – 5 PM

Order of Events Subject to Change

- 2 PM – Briefing Doors Open

- 2:30 – 3:45 PM – Logistics & Priority Issue Overview

- 3:45 – 4:15 PM – Coffee & Refreshment Break

- 4:15 – 4:45 PM – Keynote Presentation

- 4:45 – 5:00 PM – Closing Remarks

Welcome Reception & Dinner | 6 – 9 PM

**Please email Nicolina any dietary restrictions or food allergies**

________________________________________

Tuesday, April 8

Breakfast at the hotel’s restaurant is included with your stay.

- 8:15 AM – Group Photo at the U.S. Capitol (Time & Location TBD)

- 8:30 AM – 3:30 PM – Congressional Meetings

- 5:30 PM – Debrief & Closing Discussion (Location TBD)

- Evening – Free Time to Explore D.C.

Talking Points

Get a Photo Early: If the legislator is present, they may need to leave early, so try to get a photo at the beginning of the meeting. If the legislator is unavailable, take a group photo in front of the office sign or inside the office.

Share Your Story: The most impactful thing you can do is explain how a bill affects your business, employees, or hiring ability. Personal stories help legislators understand the real-world impact of policies on their constituents.

Avoid Arguments: If a legislator or staffer disagrees on an issue, don’t engage in debate—move on to the next topic. You can politely correct misinformation, but it’s best to keep the conversation constructive.

It’s Okay Not to Know: If you’re asked a question you can’t answer, be honest. Let them know you’ll follow up and ensure ABMA staff gets back to them with the right information.

Expect Schedule Changes: Votes, committee meetings, or other obligations may shift your scheduled time. If that happens, Nicolina will send a text with any updates.

Introduce yourself & the business you represent

Introduce ABMA

- ABMA is a volunteer-driven coalition

- Tell them how you got involved; tie it to an issue

Issues

- Tie it to a personal story

Give your real-world - examples of what the legislation seeks to

address

Wrap-up

Say “Thank You”

- Give them your contact information. Ask for the best way to

reach them - ABMA has supplied your group with a hand-out for each congressional office you’ll meet with today. Make sure to leave it

behind. - Let lawmakers know that ABMA has data and resources available. Tell them to scan the QR code on their hand-out to access it.

- Invite them for a yard tour to see operations firsthand, speak with employees, and better understand the people behind the industry.

Don’t Forget to Tell us How it Went! Click Here to Access Our Post-Meeting Survey

Personal stories are one of the most effective ways to make an issue real and relatable for legislators. When speaking with members of Congress, follow these guidelines to ensure your story is impactful and ties directly to ABMA’s legislative priorities.

1. Keep It Concise & Focused

Keep your story brief and to the point—aim for 1-2 minutes max to hold their attention.

Focus on one key issue (workforce shortages, swipe fees, tax policy, etc.) and explain how it impacts your business and community.

2. Make It Personal & Relatable

Connect the issue to your business and employees—describe how it affects hiring, pricing, customer service, or overall operations.

If applicable, share how a specific federal policy has helped or hurt your business.

3. Use Real-World Examples

Instead of broad statements, use concrete examples:

“Our swipe fees cost us an extra $50,000 last year—money we could have reinvested in hiring.”

“We’ve had an open CDL driver position for 6 months because federal training rules are outdated and costly.”

“The inability to pass down our business without major tax penalties could mean the end of our family-owned operation.”

When meeting with legislators, it’s important to introduce the American Building Materials Alliance (ABMA) and explain its role in advocating for independent lumber and building materials (LBM) dealers. Here are key points to share:

Who We Are: The ABMA is a volunteer-driven coalition of industry leaders advocating for independent lumber and building material dealers, which are mostly small and medium-sized businesses.

What We Do: We connect policymakers with industry insights to help shape policies that support our customers, employees, and businesses while ensuring a strong future for the communities we serve.

Our Economic Impact: ABMA members sustain hundreds of thousands of good-paying jobs nationwide, often serving as a gateway to lifelong careers in local communities.

Our Role in the Supply Chain: Our businesses play a vital role in the construction industry, connecting manufacturers to job sites where homes, businesses, and infrastructure take shape.

Why It Matters: The policies discussed today directly impact housing affordability, workforce development, and small business sustainability—all critical to our industry’s success and the communities we support. decisions affect their business, workforce, and local economy.

Workforce development is a key priority for the lumber and building materials (LBM) industry. Many businesses are facing labor shortages, while outdated federal policies create barriers to hiring and training skilled workers. When meeting with members of Congress, use the following guidelines to effectively communicate the importance of workforce development and advocate for solutions that support the industry.

1. Share Your Personal Experience

Legislators respond best to real-world examples. Be prepared to share how workforce shortages are affecting your business, your ability to expand, or your customers. Consider these points:

Are you struggling to find qualified CDL drivers, crane operators, or skilled tradespeople?

Have you had to turn down projects or delay deliveries due to a lack of workers?

What barriers do you face in hiring and training employees?

2. Emphasize the Need for Employer-Led Training Programs

Current federal training requirements, such as CDL licensing rules and OSHA crane certification, are misaligned with industry needs and create costly, unnecessary barriers to workforce entry.

Employer-led training programs allow businesses to train workers on the job, ensuring they gain relevant, industry-specific skills without the burden of expensive third-party programs.

Congress should support policies that expand access to employer-based training and apprenticeships in the LBM industry.

3. Advocate for Federal Support for Workforce Development

Encourage lawmakers to:

Expand funding for industry-led workforce development programs. Workforce grants should include training for the LBM industry, which provides stable, well-paying careers in communities across the country.

Support employer-based training solutions. Programs that allow businesses to provide on-the-job training for CDL drivers, crane operators, and other specialized roles will remove hiring barriers and get more people into the workforce.

Streamline federal training requirements. Current licensing and certification programs should be updated to better reflect real-world industry needs.

4. Offer to Provide More Information or Data

- Let lawmakers know that ABMA has data and resources available to help them better understand workforce challenges in the LBM industry.

- Offer to provide follow-up information on the impact of workforce shortages and the benefits of employer-driven training programs.

- If they are interested, ABMA can share details on how similar industries have successfully implemented workforce development initiatives.

- Invite them for a yard tour to see operations firsthand, speak with employees, and better understand the workforce needs and career opportunities within the industry.

Federal tax policy has a direct impact on the affordability of building materials, the ability of LBM businesses to invest in growth, and the overall stability of the construction supply chain. When meeting with members of Congress, use the following guidelines to effectively communicate the importance of tax policies that support the industry.

1. Share Your Personal Experience

Legislators respond best to real-world examples. Be prepared to explain how tax policy affects your business operations, ability to invest, and long-term sustainability. Consider these points:

How would restoring full bonus depreciation impact your ability to invest in new equipment or expand your operations?

Have changes in tax policy affected your ability to hire or retain workers?

What impact would the expiration of the Sec. 199A small business deduction have on your bottom line?

How would an increase in estate taxes impact family-owned LBM businesses in your community?

2. Advocate for Policies That Keep Building Materials Affordable

Bonus Depreciation (Full Expensing) – H.R. 7024: Restoring full expensing allows businesses to immediately deduct major capital investments, such as delivery trucks, forklifts, and sawmill upgrades, reducing costs and improving supply chain efficiency.

Sec. 199A Deduction for Pass-Through Businesses: Small businesses structured as S-Corporations, partnerships, or sole proprietorships rely on this 20% deduction to stay competitive. Without it, tax burdens will rise, making materials more expensive.

Estate Tax Reform & Preservation of Stepped-Up Basis: Many LBM businesses are multi-generational family operations. Without stepped-up basis, heirs could face large capital gains taxes on inherited assets, forcing sales or closures that would disrupt supply chains and limit competition.

3. Emphasize the Impact of These Policies on Housing and Jobs

Encourage lawmakers to:

Support tax provisions that lower operational costs for suppliers. Reducing business tax burdens helps keep material costs stable, preventing unnecessary increases in housing prices.

Protect small businesses and local suppliers. Family-owned businesses are the backbone of the LBM industry. Congress must ensure they are not disproportionately impacted by tax increases.

Promote investment in workforce and infrastructure. When tax policies allow businesses to reinvest in equipment and employees, it strengthens local economies and creates long-term stability in the housing market.

4. Offer to Provide More Information or Data

Let lawmakers know that ABMA has data and resources available to help them understand how tax policy impacts the LBM industry and housing affordability.

Offer to provide follow-up information on how tax reforms, such as the Sec. 199A deduction or bonus depreciation, directly impact local businesses.

Share success stories of how tax provisions have helped businesses invest, hire, and expand.

Invite them for a yard tour to see firsthand how LBM businesses operate, speak with employees, and understand how tax policy decisions impact local jobs and the housing supply chain.

Credit card processing fees have become one of the largest expenses for small businesses, increasing costs for suppliers, builders, and consumers. The Credit Card Competition Act aims to introduce market competition to reduce these fees and ensure fairer pricing for businesses. When meeting with members of Congress, use the following guidelines to effectively advocate for swipe fee reform.

1. Share Your Personal Experience

Legislators respond best to real-world examples. Be prepared to explain how high credit card fees affect your business and customers. Consider these points:

What percentage of your transactions are paid by credit card, and how much do you pay in swipe fees each year?

Have rising processing fees forced you to raise prices or reduce services?

How do big-box retailers benefit from lower negotiated rates while small businesses like yours have no choice but to pay higher fees?

2. Advocate for the Credit Card Competition Act

The bill introduces competition into the credit card processing market by requiring large banks to enable at least two processing network options for transactions, breaking up the Visa-Mastercard duopoly.

It does not eliminate credit card rewards or limit access to credit, despite claims from opponents. Instead, it lowers transaction fees, which helps small businesses keep prices lower for consumers.

Visa and Mastercard currently control over 80% of the market and set swipe fees without competition, leading to ever-increasing costs. The bill simply allows businesses to choose lower-cost networks, just like they do with debit cards.

3. Emphasize the Impact on Small Businesses and Consumers

Encourage lawmakers to:

Level the playing field for small businesses. Big-box retailers negotiate lower rates, but independent businesses have no bargaining power, forcing them to pay inflated fees.

Reduce costs for consumers. Swipe fees get passed down in the form of higher prices on building materials, increasing housing costs and inflationary pressure.

Promote fair competition in the payments market. Allowing businesses to choose from multiple processing networks would drive down fees through market forces, just as it does in the debit card industry.

4. Offer to Provide More Information or Data

Let lawmakers know that ABMA has data and resources available to help them understand how swipe fees impact the LBM industry and local economies.

Offer to provide follow-up information on the Credit Card Competition Act and how similar reforms in debit card processing have successfully lowered costs.

Share statistics on how swipe fees have skyrocketed in recent years and how reform would directly benefit small businesses and their customers.

Invite them for a yard tour to see firsthand how swipe fees impact operations, speak with employees, and understand how lower processing costs would benefit businesses and consumers.

ABMA Advocacy Day Post-Meeting Survey

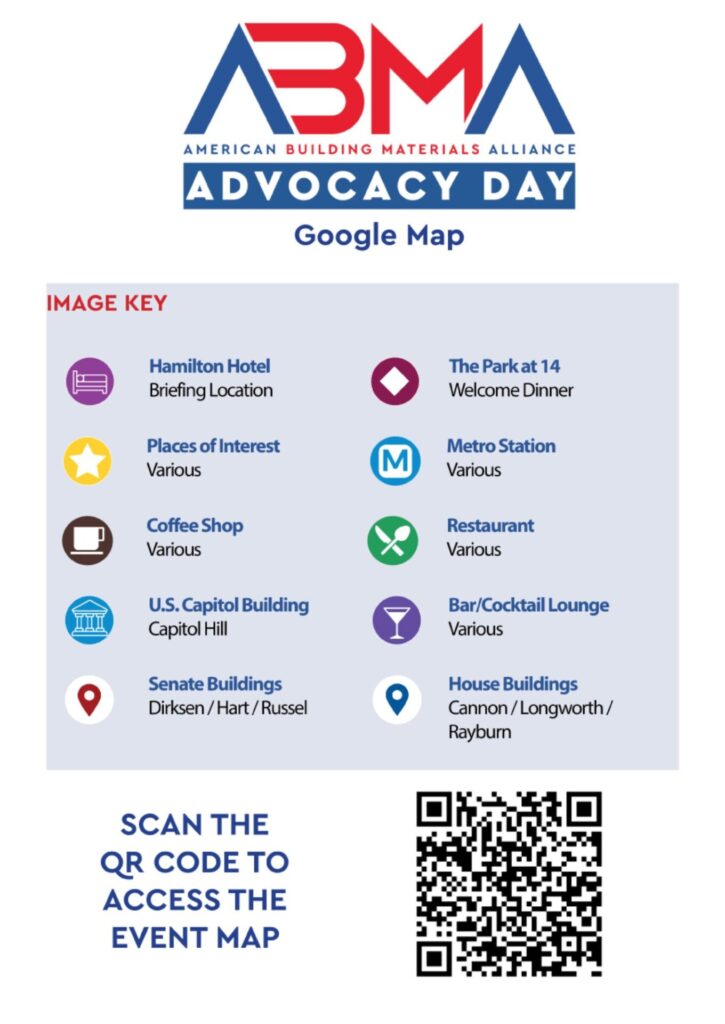

Advocacy Day Event Map

- Event Addresses

- Map Key

- D.C. Visitor Links

- Joint Tax Hearing

Hamilton Hotel DC:

1001 14th St NW, Washington, DC 20005

The Park at 14th:

920 14th St NW, Washington, DC 20005

U.S. Capitol:

East Capitol St NE & First St SE, Washington, DC 20004

- D.C. Maps

- Note on Office Numbering

- U.S. Capitol Grounds

- Capitol Visitor Center Indoor Map

- Navigating D.C. Metro

- Visiting Capitol Hill

- Things to Do